With the Inyova Pillar 3a, you can invest sustainably for your pension!

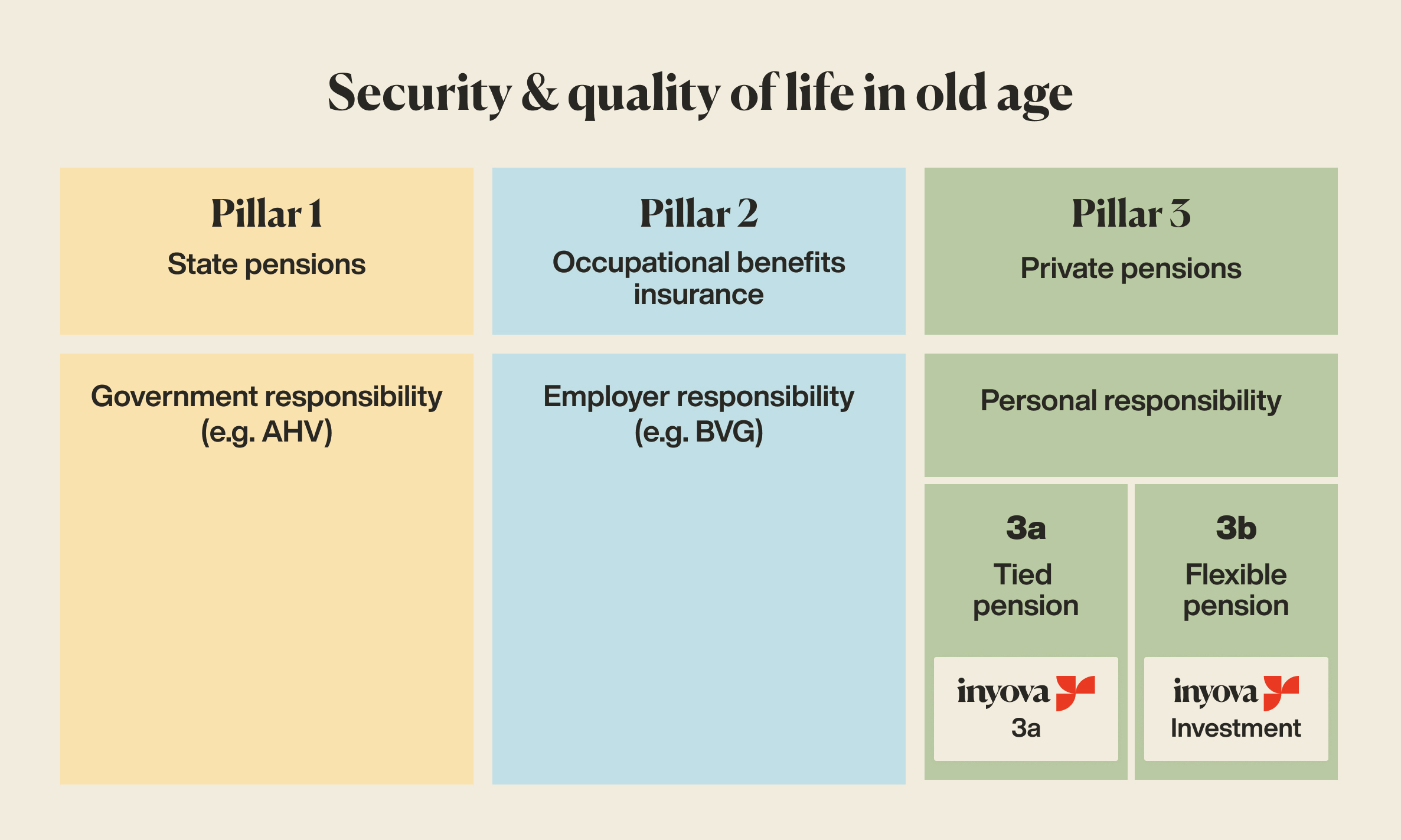

The pension system in Switzerland is divided into three pillars. The 1st pillar is a state pension (AHV), the 2nd pillar is the occupational pension (pension fund / BVG) and the 3rd pillar is a private pension.

In general, you put money aside in the 3rd pillar so that you can maintain a good quality of life once retired. Because after retirement, the 1st and 2nd pillars only cover part of the desired standard of living for most people.

This third pillar is divided into Pillars 3a and 3b.

With your Inyova Pillar 3a you can make real change - by investing in companies that actively contribute to solving the greatest sustainability problems of our time. An Inyova Pillar 3a is fully personalized and has a low and transparent price. The Inyova Pillar 3a also offers tax advantages.

Here’s how to start your sustainable Pillar 3a with Inyova.

When can I withdraw money from Inyova Pillar 3a?

In general, you are legally obliged to have the entire Pillar 3a paid out when you retire (or at least five years before that). If you would like to work longer than the age of 65, you can postpone the lump-sum withdrawal up to a maximum of age 70.

You can withdraw your money before you reach retirement age if you:

- Want to use it for the purchase or construction of an owner-occupied home or

- Move abroad to live there permanently or

- Start your own company (you are self-employed) or

- Are unable to work and receive a full disability benefit.

A single Pillar 3a account can only be withdrawn in full; partial payments are not possible. However, you can also open several Pillar 3a accounts with different providers.